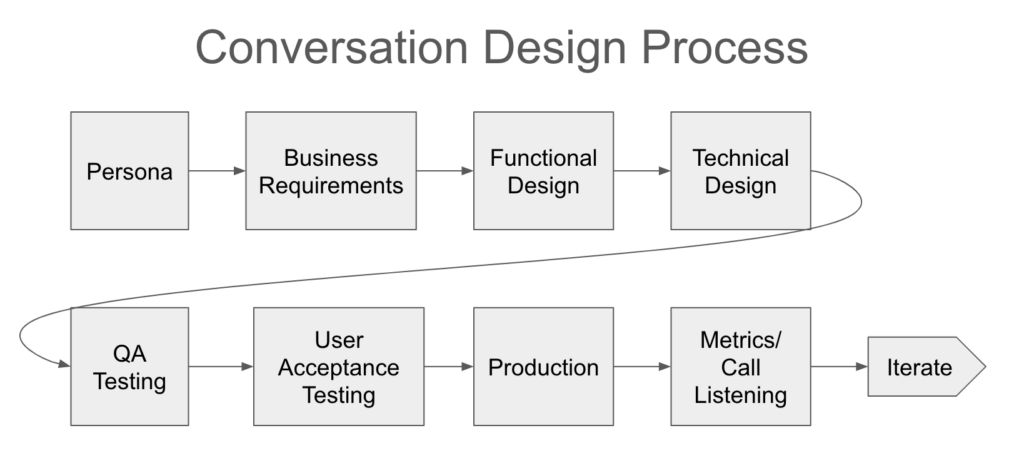

Conversation Design

Process

- Persona Review

- Identify what is relevant for the business needs

- Business Requirements definition and decomposition

- Business case, such as volume, dissatisfaction, etc.

- Document any client business rules, and notate any relevant legal or regulatory requirements

- Document what the enhancement needs to accomplish including measurable goals

- Review with client Subject Matter Experts

- Customer Service Representatives and Live Agents

- Learn about key issues and how they handle calls and, in particular, challenging situations

- Functional Design and Client Approval

- Proposed hi-level conversational flows and prompting examples

- Flow diagrams as needed

- Includes Sample Dialogs

- Technical Design and Client Approval

- Call flows design in either a canvas-based tool or in Word

- Intent design

- Modular-based design

- Call-flows

- Function and API work by Developers

- Call flows design in either a canvas-based tool or in Word

- QA testing (Dev/QA environment)

- Support QA as needed

- Address issues and iterate

- User Acceptance Testing and Client Approval(UAT environment)

- Support client as needed

- Prioritize and address issues and iterate

- Production Release

- Metrics measurement and call listening

- Prioritize any issues found, ticket them and schedule for a Jira release

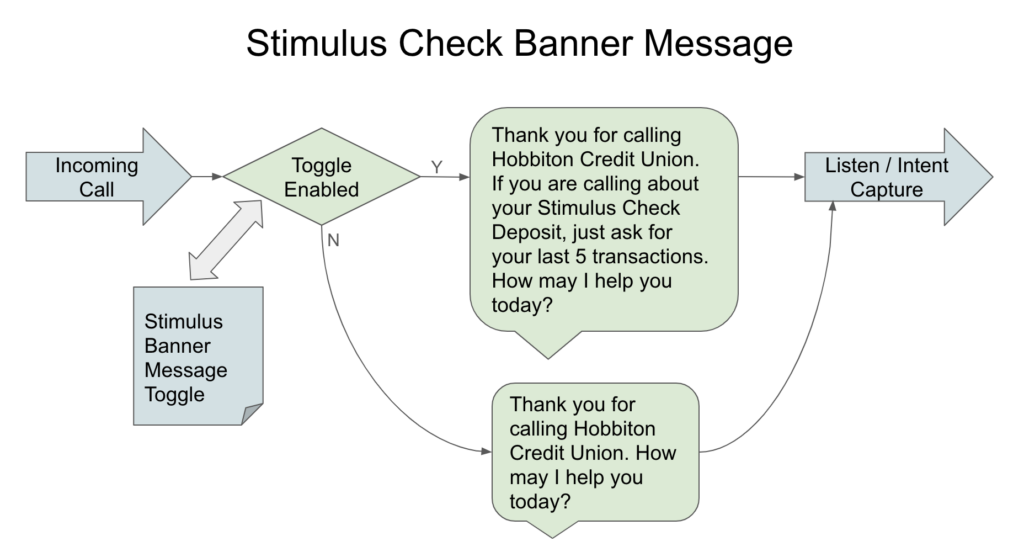

Managing Stimulus Check Calls – A Success!

Situation

The client was a Credit Union. The US Government had announced emergency stimulus checks had been issued. In turn, the Credit Union was flooded with calls from customers to find out the status of their deposit, and was overwhelming the Live Agents. In most cases customers would ask for Live Agent repeatedly at the beginning of calls.

Task

Find a way to help customers use self-service to get the information they need, and minimize the volume of calls routing to Live Agents.

Action

The IVA already had in place self-service for account balance inquiries and hearing their last 15 transactions (5 at a time). The change was to draft add several “banner” messages, English and Spanish, which would play at the beginning of the call.

The banner messages were enabled/disabled via and Administrative Web Portal, so that they can be turned on and off as needed in real time.

The banner messages informed customers that if they are calling about the status of their Stimulus check deposit, to ask for their last 5 transactions. The existing intent would be used for providing transaction information. After Authentication, the IVA would provide the transaction details, helping the customer without having to route them to a Live Agent.

Result

The result was a significant reduction in calls routed to Live Agent. Use of toggles to enable/disable the banner messages made it easy to manage, and came in handy when additional rounds of stimulus checks were released.

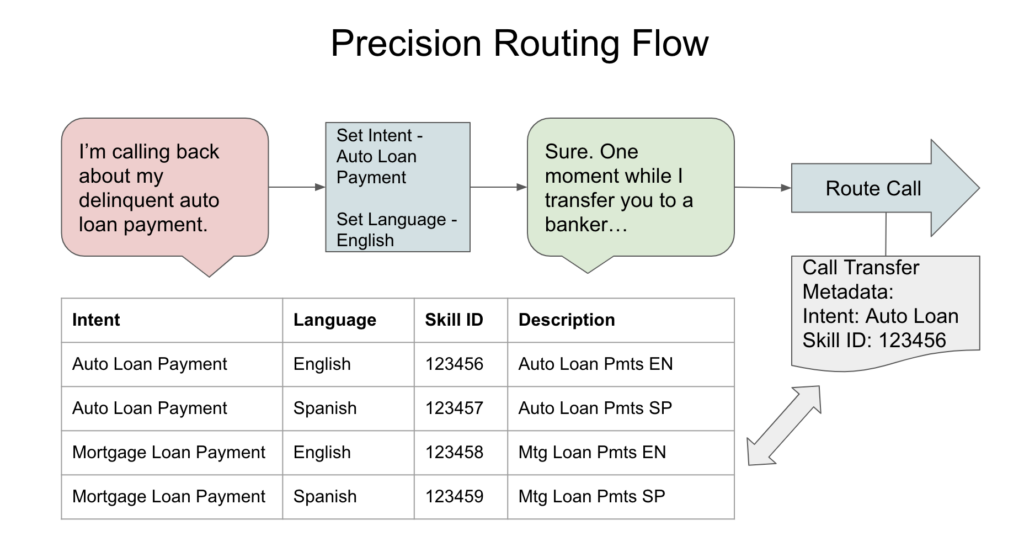

Precision Routing – A Success!

Situation

The client is a Credit Union. Many Live Agents are trained in a variety areas where they can provide support. The problem is when routing to a particular department, the Agent might not have the specific training needed to help the customer, and then would need to transfer them.

This resulted in a lot of Agent-to-Agent calls, resulting in a bad experience for both the Customers and the Agents

Task

The task was to develop a way to route customers to the “right Agents” in a more accurate manner, to minimize Agent-to-Agent transfers.

Action

The client re-identified each agent by “Skill ID”. An example skill is handling auto loan inquiries (English), and then assigning it a value such as 123456. This would be distinct from a skill such as handling personal loan inquiries (Spanish), which would then have a different value such as 123458. Each Agent would have several skill IDs associated with them, depending on their training and experience.

To manage this, two additional web pages were added to the Client’s Administrative Portal. The first was a list of the numerical Skill IDs, their service type, and language (English or Spanish).

The second page was a list of the intents/sub-intents. The Skill IDs were then assigned to each intent.

In the IVA, several additional disambiguations were added to help with routing precision.

In turn, when a call transfers, metadata was sent along with the call with the Skill ID associated with the intent. The Client’s telephony system (NICE/CXOne, in this case), would then route the call to an Agent with the particular skill.

Result

The number of Agent-to-Agent transfers were reduced, benefiting both the Customers as well as the Agents.

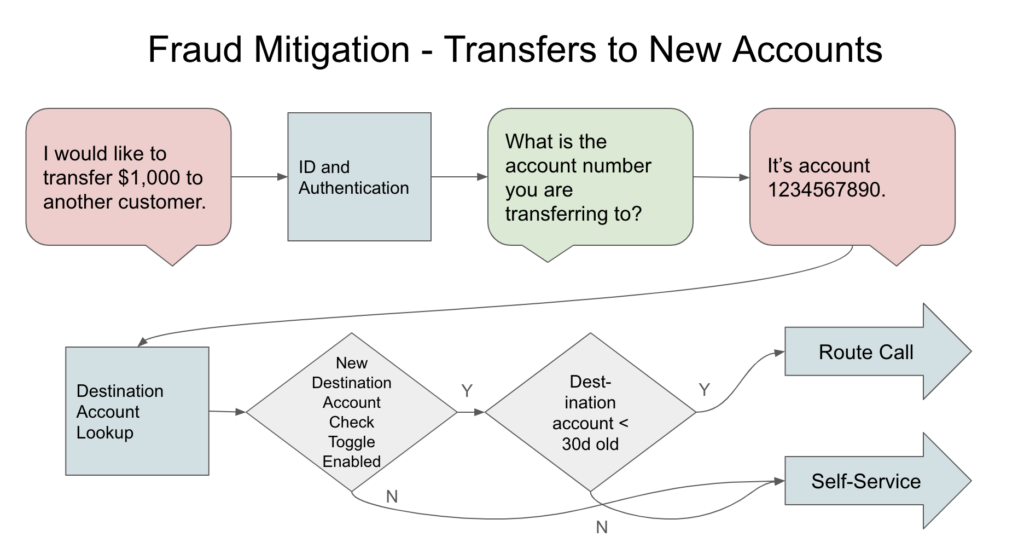

Mitigating Fraud – A Success!

Situation

A Credit Union reported an increase in a particular type of fraud. Situation:

- Fraudsters were creating new accounts

- Fraudsters then use Phishing tactics to obtain customer credentials

- The fraudsters would then either use the IVA or reach a Live Agent, and request a funds transfer from the customer’s account to the new account.

- The fraudster would use the stolen credentials to successfully Authenticate in the IVA in particular.

- The transfer might be from either the customer’s regular cash accounts, or take a cash advance on a credit card.

- The fraudster then would withdraw the stolen cash from the account

Task

Develop a way to mitigate this type of fraud via the IVA. In parallel, the Credit Union was taking steps to help their Live Agents detect this type of fraud as well.

The ID and Authentication flows were already considered pretty secure, and it was challenging to minimize Phishing. In addition configurable transfer limits were in place in the IVA. For example, a business rule was already in place to transfer calls to an Agent if the transfer amount was $10K or more.

Action

A key characteristic was that fraudsters were creating new accounts. In turn, we added a way to detect if the “to” account was created in the last 30 days.

In the conversational flow, the customer would provide the “to account” for funds transfer. At this point, an API call would retrieve information about the account, and a feature was added to check if the account was less than 30 days old. A business rule was added to transfer the call to a Live Agent in these cases. A toggle for this feature was added so that it could be disabled in the future if this type of fraud alleviates, and in turn manage containment in a balanced manner.

Result

The client reported a reduction in this type of fraud occurring through the IVA once this feature went into Production.

Routing Customers with Delinquent Loans – A Failure!

Situation

The Credit Union reported that the number of delinquent loans was increasing, and they would like to route customers in this situation as quickly as possible to Loans personnel so they could help them.

Task

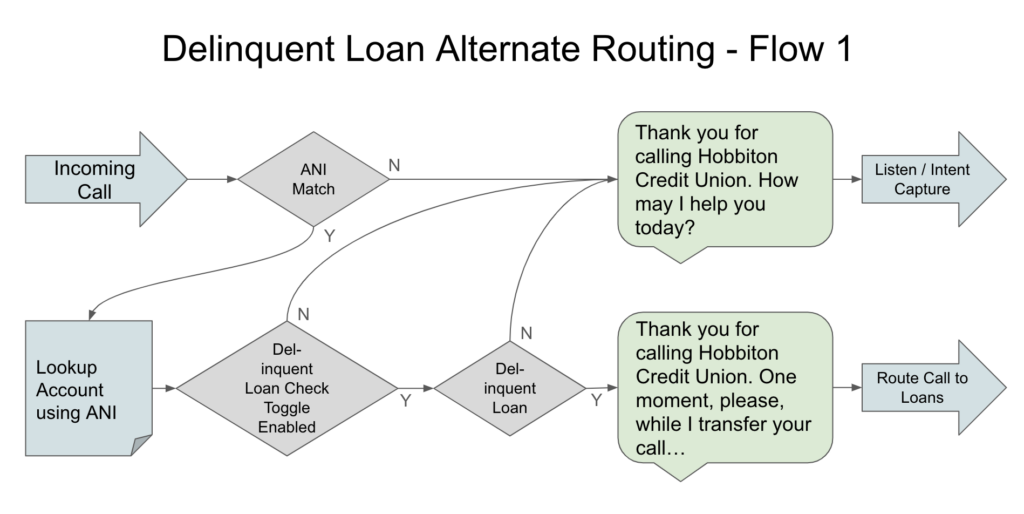

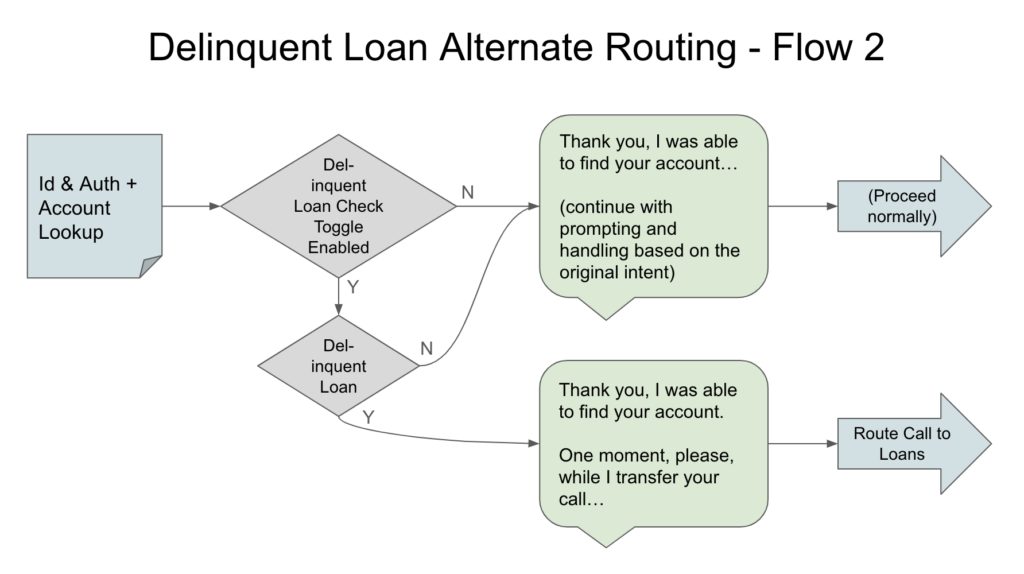

The proposed solution was to route callers to Loans as quickly as possible once it is detected the customer was delinquent:

- At ANI Match at the very beginning of the call

- If an ANI Match was successful, find the account. If the account indicated the loan was delinquent, play an appropriate message and then route the caller to the Loans department

- After ID and Authentication either prior to transfer or at the beginning of a self-service request

- One the caller was authenticated, the account information was checked for delinquent loans. If so an appropriate message was played and the caller was routed to the Loans department.

- If the caller had asked for an Intent for which the IVA could provide self-service, this was ignored rather than providing the requested service, as the concern was the caller might hang up afterwards before the IVA could route them to Loans.

Action

The above features were implemented in Production. A key feature was to include a toggle to enable/disable this feature in the Client Administrative Portal in real time.

Result

Once in production, the Loans Department was flooded with incoming calls, resulting in extremely long hold-times. The toggle for this feature was disabled by the client pretty quickly after it had gone live.

Post-Mortem

There were a number of lessons learned.

- The volume of calls which would route to the Loans department was heavily underestimated.

- The potentially bad customer experience was discussed while planning the enhancement.

- The expected negative experience of suddenly being routed to Loans, when they were calling for a different reason, was discounted.

- The feeling at the Credit Union was that the need to help their customers as quickly as possible with their Loan issues outweighed everything else.

In retrospect, as a Designer, I should have pressed the anticipated bad customer experiences with this type of call handling. I wasn’t enough of a “customer advocate” in this case.

Also, the client should have researched the anticipated call volume more thoroughly, and as a Designer, I should have emphasized the need for this more heavily.

Finally, rather than simply having a simple enable/disable feature for the toggle, I should have included a “percentage” of calls setting in the Administrative portal, to help manage the volumes. For example, route only 10% (1 in 10) calls using this new feature, until we understand the Loans department’s ability to take an manage the call volumes.

Generative AI Image and Animation

Recently I’ve begun to learn about Generative AI basics, and while doing so focused on using these new technologies to try new things and initiate some new personal projects.

In my new Youtube channel, “Catholic Rosaries, Prayers and Psalms,” I’ve started sharing content to learn how I might engage with a different type of audience.

Youtube: Catholic Rosaries, Prayers and Psalms

Tech Stack:

- Scrivener (Scripting, planning, storyboarding)

- Rime AI (Text-To-Speech)

- Garageband (Voice and music editing)

- Google Gemini and ChatGPT (Image idea generation)

- Google ImageFX / Imagen 3 (Image generation)

- Kling AI (Animation generation)

- iMovie, Adobe Premiere Rush and Capcut (Video editing)

Self-Improvement

Over the last several months I’ve been working through ad-hoc tutorials and online courses to learn the basics and start gaining an understanding on how Generative AI technology can be leveraged in Conversation Design and Voice Applications.

- Generative AI basics

- Prompt Engineering

- Use of Voiceflow for AI Agent development